Starting your own business in New York can be an exciting and rewarding journey. However, many aspiring entrepreneurs feel intimidated by the legal complexities of registration. The good news? You don’t need a lawyer to get started. With the right guidance, you can handle the entire process yourself. This guide, titled “Start Smart: How to register a business in New York Without Legal Help,” breaks down everything you need to know in simple steps.

1. Choose Your Business Structure

The first step in the process is choosing the right legal structure for your business. Common options include:

- Sole Proprietorship – Best for individuals running a one-person business.

- Partnership – Ideal if you’re starting a business with someone else.

- Limited Liability Company (LLC) – Offers liability protection and flexibility.

- Corporation (C-Corp or S-Corp) – Suitable for businesses that plan to raise capital or issue shares.

Most small businesses in New York opt for an LLC due to its simplicity and protection.

2. Pick a Unique Business Name

Your business name must be distinguishable from existing names registered in New York. Use the New York Department of State’s Corporation & Business Entity Database to search and ensure your desired name is available.

Tip: Consider reserving the name for 60 days for a small fee while you finalize your paperwork.

3. File the Necessary Paperwork

This is where the keyword Start Smart: How to Register a Business in New York Without Legal Help truly comes into play. Here’s what you need to file, depending on your business type:

- For LLCs: File the Articles of Organization (Form DOS-1336) with the New York Department of State. The filing fee is $200.

- For Corporations: File a Certificate of Incorporation and pay a $125 fee.

- For Sole Proprietors/Partnerships: Register a business name (DBA) with your county clerk’s office.

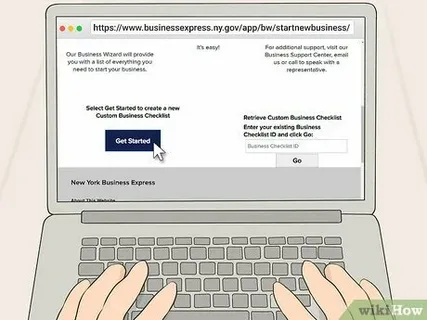

You can file online through the New York Business Express website or mail the documents.

4. Complete the NY LLC Publication Requirement (LLC Only)

If you’re forming an LLC, New York law requires you to publish a notice of formation in two newspapers for six consecutive weeks. After publication, you’ll file a Certificate of Publication with the state, along with a $50 filing fee.

Though this step may seem outdated, it’s legally required and a crucial part of Start Smart: How to Register a Business in New York Without Legal Help.

5. Get an EIN (Employer Identification Number)

An EIN is like a Social Security number for your business. You’ll need it to open a business bank account, hire employees, and pay taxes. The best part? It’s free and easy to apply online through the IRS website.

6. Register for New York State Taxes

Depending on your business type and what you sell, you may need to:

- Collect and pay sales tax

- Withhold payroll taxes for employees

- Pay corporate taxes

Register your business for taxes through the New York State Department of Taxation and Finance.

7. Obtain Any Required Permits or Licenses

Certain businesses require special permits or licenses to operate in New York (e.g., restaurants, salons, contractors). Use the NY Business Wizard tool to determine what’s needed for your business.

Conclusion: You Can Do It Yourself

There’s no need to feel overwhelmed. With the right resources and a little patience, you can confidently tackle the entire registration process. As this guide to Start Smart: How to Register a Business in New York Without Legal Help shows, legal help is not always necessary to get your dream off the ground. Take control, save money, and start your business the smart way—on your own terms.